How does authorization and capture work in OneClick payments?

Separate authorization and capture on subscribed cards to create a charge now and capture funds later.

This functionality is available for the following models:

☑ Acquirer

☑ Aggregator

Receive OneClick payments using the authorization and capture scheme involve securely storing your customer’s card information, guaranteeing fund availability and providing the flexibility to capture a specific amoun until the service is completed. It also allows capturing different amount than the original authorization

Operation Details

| Particularity | Details |

|---|---|

| Supported card types | Visa and Mastercard debit and credit cards |

| Authorization duration | 7 days for debit cards and 28 days for credit cards. |

| Authorization end time | 7 days or 28 days from the time the authorization is generated |

| Reauthorization amount | Can be higher or lower than the authorization amount. There is not maximum limit |

| Capture amount | The maximum amount to be captured may be 10% higher than the total amount of the initial authorization plus the n reauthorizations that may be executed |

| Number of captures | Only 1 capture per authorization is allowed |

| Cancellation of authorization before the expiration date | Recommended, using the void endpoint |

| Cardholder limit restoration upon cancellation | The limit is immediately restored, but note that it is subject to variations, depending on the issuer |

| Cardholder limit restoration upon authorization validity expiration | The limit is immediately restored |

Process steps

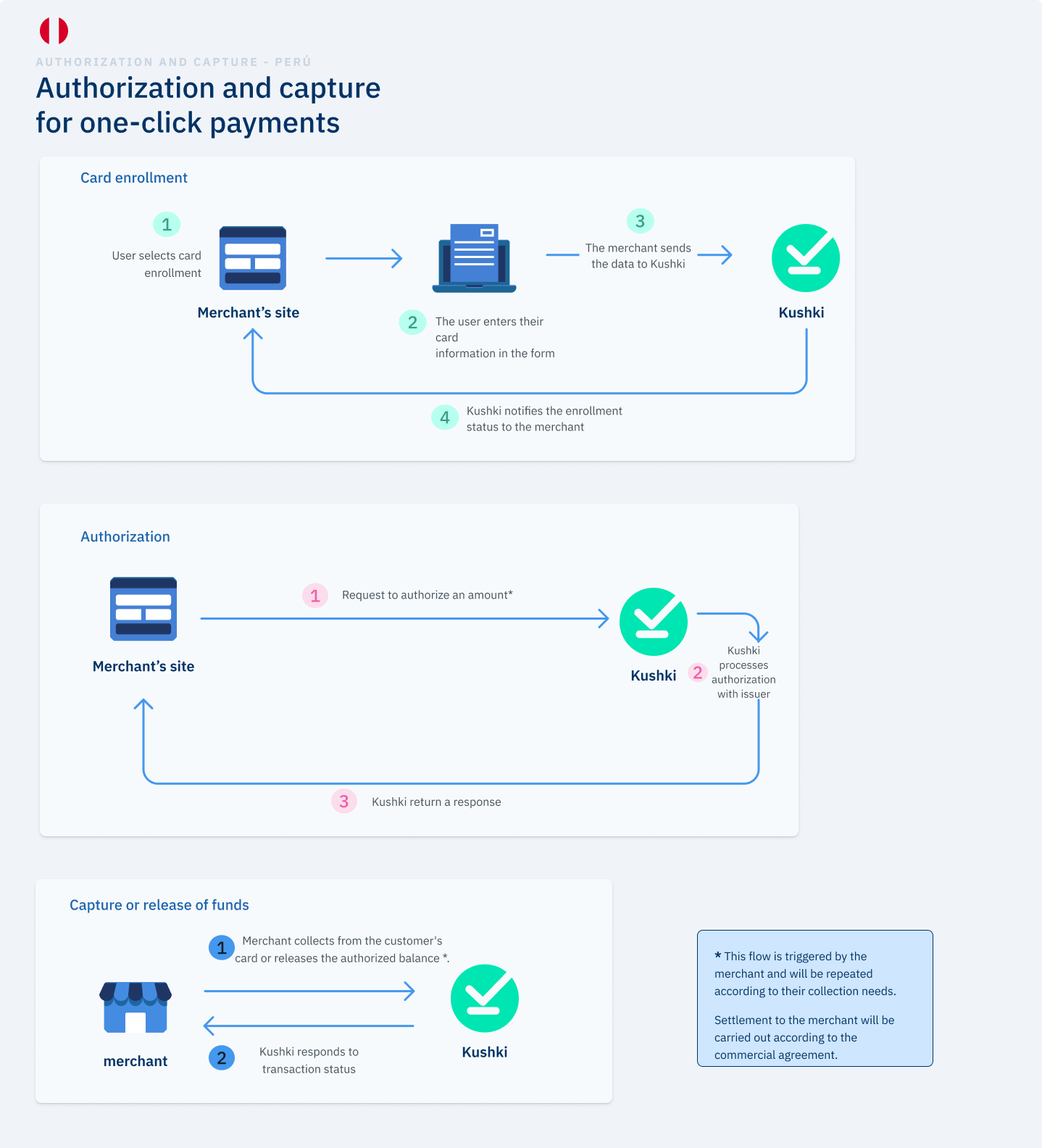

The OneClick payment with authorization and capture, consists of three stages: tokenize the card data, authorize the amount and capture or release the funds.

Card Registration

1. Payment Method Selection

On your website or app, the user selects the payment method. Make sure the payer understands that their card will be enrolled, meaning their data will be stored for future charges as needed.

2. Data Entry

The user provides the card information for payment. Your website or app must verify the card accuracy of the information (example, checking the expiration date or ensuring the card number obeys Luhn’s algorithm). At this point, there is still no guarantee that the card is valid.

3. Data Submission to Kushki

Kushki receives the data and verifies if the card’s associated account has sufficient funds through a validation charge. This charge checks if the card is active and in balance and will be automatically reversed.

4. Notification

At this stage we will show you the result of the card enrollment so that you can display it on screen to the user.

Authorization

1. Amount Authorization

Merchant requests Kushki to authorize the amount on the customer’s card.

2. Funds Verification

Kushki processes authorization with the issuer, verifying funds availability. If this process is successful, it holds that amount on the customer’s card to guarantee it to the merchant.

3. Notification

Kushki returns a response from the authorization process.

Capture or release of funds

1. Execution of the charge

Once you have authorized the amount of your customer’s card, you can request the collection or release of the authorized balance.

2. Notification of transaction status

At this stage you will be notified of the status of the transaction. You can receive these notifications to a webhook that you expose for Kushki to consume. You also have the Kushki console to check the transactions along with the detail of each transaction and the status.

Receive payments *OneClick* with authorization and capture

Learn how to integrate the OneClick payment reception through the authorization and capture scheme.

Chile

Chile Colombia

Colombia Ecuador

Ecuador Mexico

Mexico