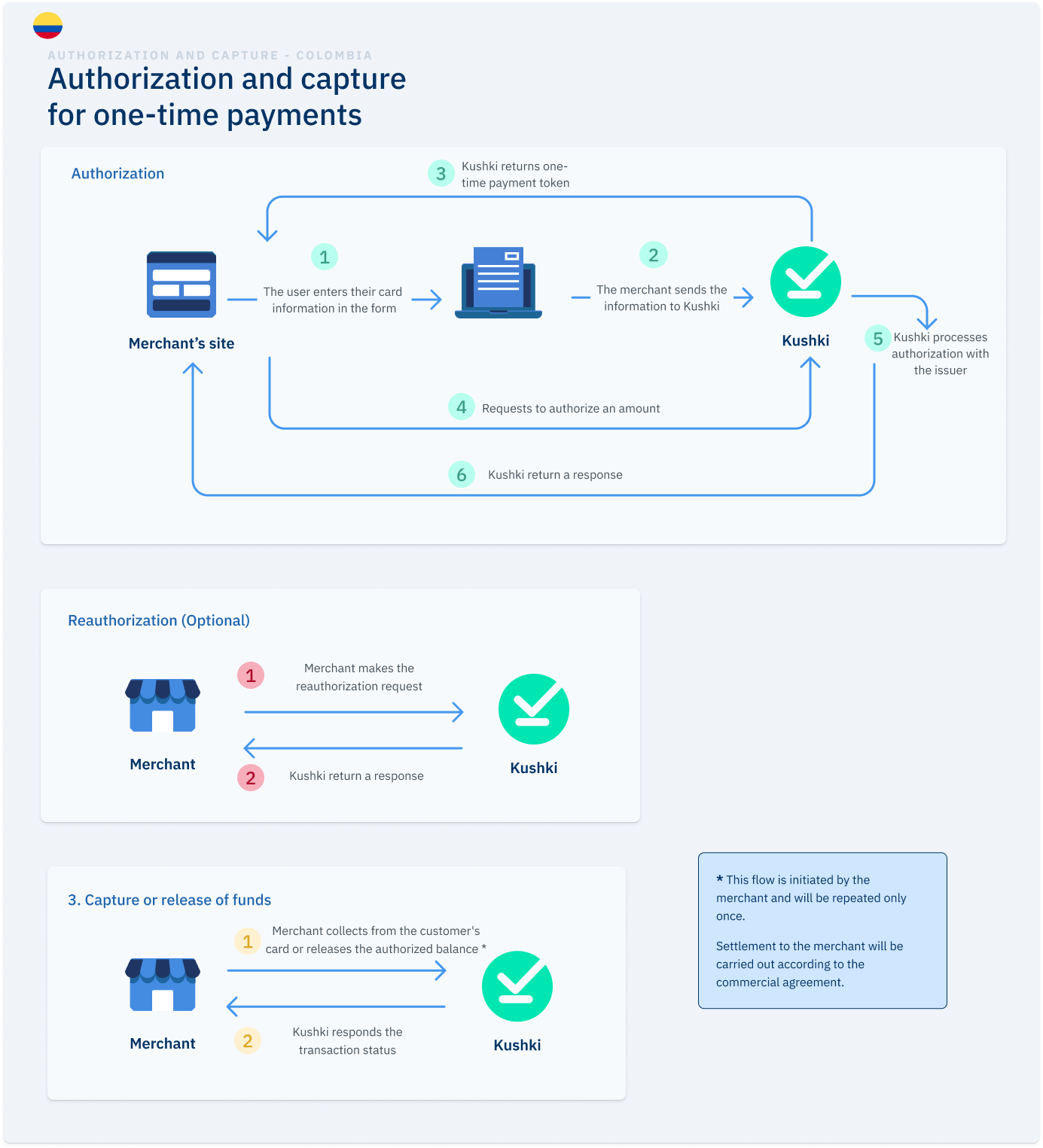

How do one-time payments with authorization and capture work?

Learn about the authorization and capture process, through which you can authorize an amount from your client's card and charge when the service has been completed.

This functionality is available for the following models:

☑ Acquirer

☐ Aggregator

Receiving one-time card payments under the authorization and capture, involves reseiving funds from your customer’s card, allowing executing the capture of funds once the service is completed. It also allows reaothorizations to extend the validity of the funds or change the initial amount.

Operation Details

| Particularity | Details |

|---|---|

| Supported card types | Visa and Mastercard debit and credit cards |

| Authorization duration | 7 days for debit cards and 28 days for credit cards. |

| Authorization end time | 7 days or 28 days from the time the authorization is generated |

| Reauthorization amount | Can be higher or lower than the authorization amount. There is not maximum limit |

| Capture amount | The maximum amount to be captured may be 10% higher than the total amount of the initial authorization plus the n reauthorizations that may be executed |

| Number of captures | Only 1 capture per authorization is allowed |

| Cancellation of authorization before the expiration date | Recommended, using the void endpoint |

| Cardholder limit restoration upon cancellation | TThe limit depends on the issuer to be restored |

| Cardholder limit restoration upon authorization validity expiration | The limit is immediately restored |

Stages of the process

Authorization and capture(also called two-step payment), consist of two stages: Authorizations of the amount and capture or release of funds

Authorization

1. Selection of payment method

On your website or app, the user selects a card as the payment method and provides the card details to be used for payment.

2. Sending data to Kushki

The merchant collects the data, sends it to Kushki, and requests a unique authorization payment token.

3. Sending the token

Kushki receives the data and sends you the unique authorization payment token.

4. Authorization of the amount

The merchant requests Kushki to authorize the customer’s card amount.

5. Verification of funds

Kuhski processes the authorization with the issuer, verifying the availability of funds. If this process is successful, it retains that amount on the customer’s card to guarantee it to the merchant.

6. Notification

Kushki returns a response regarding the authorization process.

Reauthorization

If you wish to modify the validity period of the authorization or the value of the amount, you can request a reauthorization. Keep in mind that each reauthorization adds to the value of the initial authorizations. The total sum of the initial authorization plus any subsequent reauthorizations will be the maximum amount that can be captured.

Capture or release of funds

1. Execution of the charge

Once you have authorized the amount on your customer’s card, you can request the collection or release of the authorized balance.

2. Translation status notification

At this stage, you will be notified of the transaction status. You can receive these notifications through a webhook that you expose for Kushki to consume. You also have access to the Kushki console to verify transitions along with the details of each and their status.

Receive payments with authorization and capture

Learn how to integrate the receipt of one-time card payments through the authorization and capture scheme.

Chile

Chile Ecuador

Ecuador Mexico

Mexico Peru

Peru